Welcome to the Member Resource Centre! Here you’ll find everything you need to make the most of your Discover Halifax membership.

Financial

Resources

Rights-Free Photo

& Video Gallery

Member-Only

Facebook Group

Share your info

& updates

Share Your

Photos

Advanced Tracking

Share social content

Leisure

Newsletter

Upcoming

Festivals & Events

Submit An

Event

Confirmed Meetings

& Conventions List

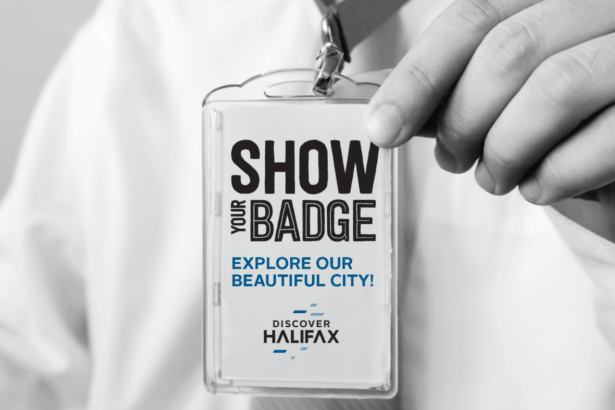

Show

Your Badge

Upload Show Your Badge Offer

Click Here

How to Update

Your Member Profile

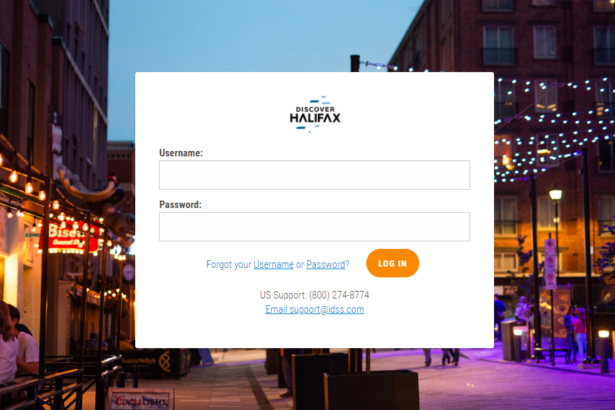

Log In

to IDSS

Become a Member

Sign-up to become a member of Discover Halifax today and discover the benefits for yourself.